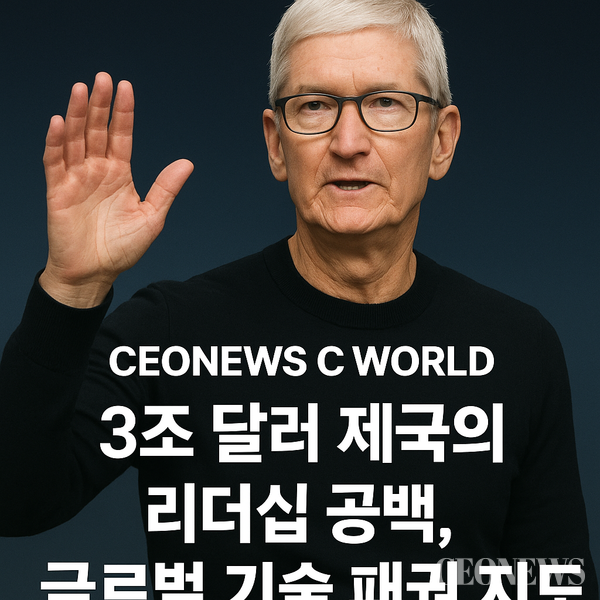

A $3 Trillion Empire Faces a Leadership Vacuum — Will the Global Tech Power Map Be Redrawn?

[CEONEWS = Reporter Choi Jae-hyuk] Silicon Valley is shaking once again. A series of reports from major international media hinting that Apple CEO Tim Cook could step down as early as next year is far more than a simple “retirement rumor.” It signals the possible restructuring of the power hierarchy inside a $3 trillion corporation with 1.2 billion active device users — one of the most influential entities in global technology and supply chains.

The question dominating markets is now singular and direct: “In the post–Tim Cook era, where is Apple heading next?”

■ The End of a 14-Year Era — The Shadow of Stagnation Over Apple

When Steve Jobs stepped down due to health issues in August 2011 and handed the baton to Tim Cook, Apple stood at a pivotal moment. Over the next 14 years, Apple expanded its revenue fourfold and its market cap sevenfold under Cook’s leadership. Yet by 2023, structural fatigue in performance, innovation, and product competitiveness had begun to surface.

▲ iPhone Dependence at 52% — A Slowing Engine

The iPhone still dominates Apple’s earnings. In fiscal year 2024, it accounted for 52% of Apple’s $391.3 billion in revenue.

But the global smartphone market has flattened to nearly 0% growth. Worse, Apple’s dominance in China has eroded as Huawei and Xiaomi overtook it.

According to Canalys, Apple’s market share in China fell to 14% in Q3 2024, dropping to third place behind Huawei (16%) and Xiaomi (15%). Huawei’s Mate 60 series, equipped with a domestically produced 5G chip, fueled “patriotic consumption,” further weakening Apple’s position.

▲ Slowing Growth in Services

Apple Music, iCloud, and the App Store continue to support the company, but their competitiveness is showing cracks in the era of generative AI.

Service revenue climbed to $85.4 billion, an 8.3% year-on-year increase — still Apple’s highest-margin business (over 70%), but clearly losing momentum.

▲ Criticism Over AI Strategy Failure

While OpenAI, Google, and NVIDIA battled for AI supremacy, Apple entered the space late, citing privacy-first philosophy and avoiding large-scale model development. The announcement of “Apple Intelligence” in June 2024 emphasized on-device AI — yet its integration with external services like ChatGPT exposed limitations.

One Silicon Valley analyst noted:

“Apple losing the initiative in AI is the Cook era’s greatest strategic error.”

The data reveals a stark truth: behind Cook’s achievements lies a deepening innovation gap.

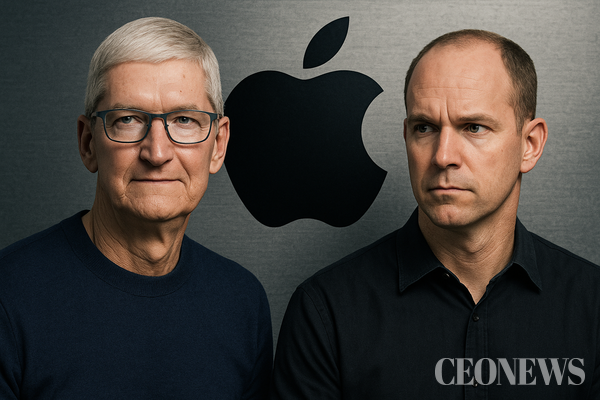

■ The Leading Successor: John Ternus — Apple’s First AI–Hardware Fusion Leader

Among global investment banks and Silicon Valley insiders, the frontrunner to succeed Cook is John Ternus, Senior Vice President of Hardware Engineering.

▲ A 20-Year Apple Veteran — Architect of iPad, MacBook, and Vision Pro

Joining Apple in 2001 as a hardware engineer, Ternus steered development for the iPad Pro, the M1/M2 Mac lineup, Apple Silicon strategy, and Vision Pro.

His greatest milestone came in 2020 when he orchestrated the historic transition from Intel processors to Apple Silicon.

▲ The Only Leader Educated Under Both Jobs and Cook

Ternus uniquely spans both eras — the design-driven ethos of Steve Jobs and the supply-chain excellence of Tim Cook.

Promoted to VP in 2012 and Senior VP in 2021, he now oversees Apple’s entire hardware portfolio.

▲ The Most Suitable Leader for Apple’s AI-Centered 2.0

Apple’s next strategic pillar is clear: “AI embedded into every device.”

Ternus is widely viewed as the ideal leader to fuse AI with Apple’s hardware ecosystem.

Bloomberg’s Mark Gurman wrote:

“Ternus is Cook’s most trusted lieutenant and the candidate who best understands Apple’s product philosophy.”

■ How Apple’s Leadership Switch Could Shake Global Tech Power

Apple is not just a tech company — it is a structural pillar of the global supply chain.

A CEO transition will send shockwaves well beyond Cupertino.

▲ Samsung: Competitive Order to Be Reshaped

If Apple Silicon shifts toward AI-centric computing, Samsung will have to recalibrate its foundry and memory strategy.

Samsung is simultaneously Apple’s biggest competitor and its major supplier of OLED displays and NAND flash.

A shift in Apple’s roadmap would directly affect Samsung’s CAPEX and AI investments.

If Apple accelerates its proprietary AI chip development, Samsung’s foundry business will also feel the impact.

▲ NVIDIA, Google, and Microsoft: The AI Power Geometry Will Shift

Apple has long concealed its AI roadmap, operating behind closed doors.

A new CEO could trigger a massive pivot toward an integrated OS–chip–service AI ecosystem.

Analysts expect Apple to deploy its own AI models across all devices — creating a third AI platform rivaling Google’s Android + Gemini and Microsoft’s Windows + Copilot ecosystems.

▲ China Risk: Mitigated or Magnified?

Cook fostered extremely strong ties with China, personally visiting the country dozens of times and maintaining a China-centric manufacturing base.

A new CEO must reconsider:

geopolitical tensions

tariffs

decoupling pressure

India/Vietnam supply chain expansion

Apple already produces 14% of iPhones in India, projected to reach 25% in 2025.

■ Why the ‘Tim Cook Exit Theory’ Is Gaining Momentum Now

Global analysts point to three key factors:

▲ Age 65 — The Traditional Retirement Line at Apple

Cook is 64, turning 65 in 2025 — the typical retirement threshold for Apple’s top executives.

Jobs stepped down at 56, and generational transition has historically occurred in the mid-60s.

▲ A Philosophical Gap Over AI Strategy

Cook’s identity rests on privacy protection and a tightly closed ecosystem.

But in the AI era, open models and large-scale data training are essential — a shift Cook may be reluctant to lead.

▲ Slowing Revenue and Stock Growth

Between 2023 and 2024, Apple’s annual revenue growth stagnated in the 1% range.

Investors want a bold new narrative — and a leadership change may be the catalyst.

■ Apple Is Entering the ‘Steve Jobs 2.0’ Era

CEONEWS projects the following outlook for the next Apple leadership:

Hardware and AI will merge completely.

Every device — iPhone, MacBook, Watch, Vision Pro — will embed on-device LLMs as a default capability.

Apple Silicon will challenge the GPU market.

Instead of competing in data centers like NVIDIA, Apple could dominate personal AI computing.

The closed ecosystem will become ‘selectively open.’

EU regulations already force Apple to loosen App Store and payment restrictions.

If Cook’s era was defined by operation and expansion,

the post-Cook era will be defined by reinvention and reset.

From Apple 1.0 (Jobs)

to Apple 2.0 (Cook),

the world now stands before Apple 3.0.

This is not merely a CEO transition —

it is a shift that will realign the gravitational field of the global tech economy.

Samsung, Google, NVIDIA, China’s manufacturing bloc, and India’s emerging supply chain will all have to redefine their positions.

Tim Cook built an empire of operational excellence.

The next leader must become a creative disruptor who redefines AI, hardware, and ecosystem strategy from the ground up.

Apple’s next CEO will redraw the global technology power map once again.