Jay Y. Lee’s Private Life, Legal Ordeals, and the Takeoff of “New Samsung”

[CEONEWS = Editor-in-Chief Jaehoon Lee] The Samsung empire is the beating heart of Korea’s economy. In July 2025, Chairman Lee Jae-yong (Jay Y. Lee) shed a decade-long legal risk when the Supreme Court acquitted him of all alleged wrongdoing related to the Samsung C&T–Cheil Industries merger (including alleged violations of the Capital Markets Act and accounting fraud). But this is not an ending—it is a starting gun. The stormy divorce, allegations of habitual propofol use, accusations of unfair merger and stock-price manipulation during succession after Chairman Lee Kun-hee’s passing, and, amid leadership vacuums, talk of President Lee Boo-jin of Hotel Shilla as an “alternative” to run Samsung—all of these are shadows cast by the “imperial management” of the group’s top owner. At the same time, there are bright spots: a ₩22 trillion–scale deal with Tesla after the acquittal, a push into 2-nanometer foundry, Samsung Electronics’ share price regaining the ₩70,000 range, and blockbuster hits with the Galaxy Z Fold7 and Flip7 among MZ consumers. This investigative report, grounded in facts, balances Samsung’s light and shadow and asks what a CEO’s misconduct does to society. Can Samsung turn crisis into opportunity?

■ The Divorce Scandal: The Bare Face of the Samsung Family

In 1998, Lee married Im Se-ryeong, the eldest daughter of the Daesang Group. In 2009—after 11 years—the two divorced by agreement, but the process was anything but quiet. Im filed suit seeking ₩1 billion in consolation money and roughly ₩500 billion in asset division—then the largest claim in Korean divorce history. Reports cited Lee’s alleged affair and inappropriate text messages as causes of conflict. Some argued tensions escalated when Daesang Honorary Chairman Im Chang-wook was arrested and Samsung showed indifference. The matter ended in settlement; Lee was said to have paid about ₩100 billion in total. Custody of their two children also stirred controversy. In 2015, when Im publicly began a relationship with actor Lee Jung-jae, the episode again drew public attention. This was not a private household matter alone. The moral failings of a chaebol owner undermine corporate trust and damage Korea’s national brand, “Samsung.” The case shows how power abuse and personal irresponsibility in a conglomerate family erode a public image—leaving Samsung the task of rebuilding trust through transparent management.

■ The Propofol Habitual-Use Allegations—What Happened

The more shocking scandal was the allegation that Lee habitually used propofol. Sparked by a whistleblower in 2020, the case centered on claims that Lee illegally received propofol at “I” Plastic Surgery Clinic in Gangnam, Seoul. Court records stated that from 2015 to 2018 he received propofol on 41 occasions, including home visits. The clinic director allegedly attempted to destroy evidence and use money to sway testimony. Samsung insisted treatments were medical, but in 2021 the trial court imposed a ₩70 million fine and ₩17.02 million forfeiture. Propofol is a medical anesthetic strictly controlled under the Narcotics Control Act; habitual use is a clear violation. The case bled into a similar controversy involving Lee Boo-jin, dragging the Samsung family into a broader “drug scandal.” Prosecutors stressed the frequency and duration and sought stern punishment, but the court considered the absence of prior offenses in handing down a relatively light sentence. The episode illustrates how a CEO’s legal violations can wound a company’s social responsibility. Samsung tightened internal rules thereafter, yet criticism of a “law-above-all” owner culture persists.

■ Unfair Merger and Stock Rigging—The Dark Shadow of Succession

Following Lee Kun-hee’s death, Samsung’s succession was marred by allegations of an unfair merger and stock manipulation. The 2015 merger of Samsung C&T and Cheil Industries was viewed as central to shoring up Lee Jae-yong’s control. The exchange ratio—1:0.35—was attacked for overvaluing Cheil (where Lee was the largest shareholder) and undervaluing Samsung C&T. Samsung C&T shareholders suffered losses; hedge fund Elliott lambasted the deal as “unfair.” Prosecutors alleged a ₩4.5 trillion accounting fraud at Samsung Biologics and stock manipulation tied to the process. After courtroom battles from 2017, Lee was acquitted on appeal in February 2025 and by the Supreme Court in July 2025. But controversy did not fade. Samsung C&T’s share price fell post-merger even as Lee’s equity value surged. Thirty-two minority shareholders (35,597 shares) filed damage suits, and the Economic Reform Research Institute flagged possible external-audit law violations. Critics say “imperial succession” sacrificed minorities and market trust. Even after acquittal, the “Republic of Samsung” stigma lingers, exposing structural problems in chaebol succession and limits of the justice system.

■ Leadership Vacuum, the “Lee Boo-jin Alternative,” and Lee Jae-yong’s Forward-Looking Leadership

Lee’s legal entanglements fueled talk of a leadership vacuum. For years, legal risk kept him at arm’s length from day-to-day management, creating “owner risk” that blunted strategic choices. Some critics said he shifted responsibility to professional managers without articulating a clear vision. In that context, Hotel Shilla President Lee Boo-jin surfaced as a potential alternative. She has led Hotel Shilla and its duty-free business decisively, drawing praise as a “Little Lee Kun-hee.” Recently, however, duty-free headwinds have made Shilla’s stock more volatile—symbolizing both leadership gaps and harsher industry conditions. Were Lee Boo-jin to move center stage at Samsung, female leadership could usher in change—but Korea’s patriarchal chaebol culture remains a hurdle.

![Chairman Lee visits Samsung Research in Umyeon-dong, Seoul, takes part in a discussion with researchers, and poses for a commemorative photo. [Photo = Samsung Electronics]](https://cdn.ceomagazine.co.kr/news/photo/202508/33980_29623_3144.jpg)

By contrast, Lee Jae-yong’s style stands out for its anti-authoritarian, down-to-earth demeanor: “de-protocol, on-site, and inclusive.” He emphasizes communication, eating in the company cafeteria with employees, snapping photos, and eschewing unnecessary formalities.

This contrasts with the cool, exacting style of Lee Kun-hee and is seen as a softer leadership that resonates with the MZ generation. In 2020 he said he would not pass management control to his children, rejecting a fourth-generation hereditary succession—an early response to criticism of dynastic management. That statement followed recommendations from Samsung’s Compliance Committee and is read as support for a professional-manager system. Rumors about his daughter Lee Won-ju “training for management” sparked doubts about sincerity, but officially he maintains the no-succession stance. His softer style, however, sometimes draws flak for lack of decisiveness in crisis—showing an organization mid-transition from owner-centric to professionalized leadership.

Chairman Lee’s outreach to MZ consumers has translated into product success. Under his forward-looking leadership, the Galaxy S25 series and Galaxy Z Fold7/Flip7 earned rave reviews and became global hits. In Q1 2025, Samsung overtook Apple in global smartphone sales; the S25 Ultra and Z Fold7/Flip7 topped bestseller lists. Among 20- and 30-somethings, preference shifted from iPhone toward Galaxy, as U.S. shipments rose 38% and younger users favored on-device AI features, design, and foldable practicality. The Z Fold7/Flip7 especially captured MZ sensibilities; social media hailed them as “all-time great foldables.” This is a case of Lee aligning product strategy with MZ needs, re-cementing Samsung’s leadership and proving his future-oriented vision works.

■ The Bright Side of “New Samsung”: Global Wins and a Rebound in Shares

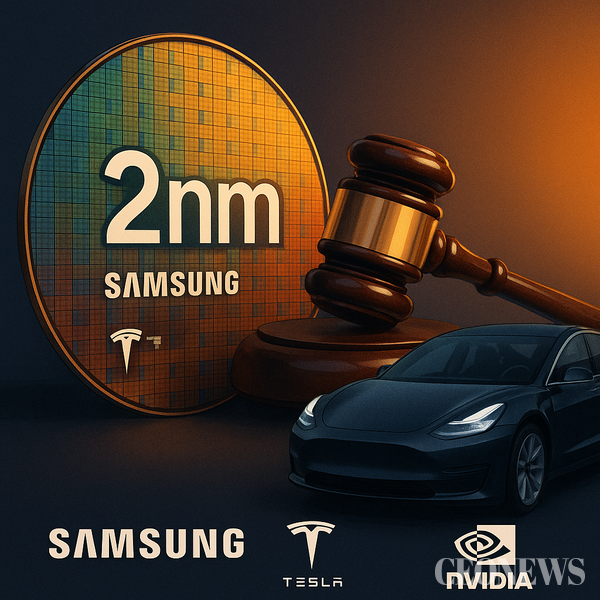

The 2025 acquittal injected new momentum. Pledging “New Samsung,” Lee promised transparency and global competitiveness. First fruits: a mega-deal with Tesla. Samsung will supply autonomous-driving AI6 chips worth $16.5 billion, with its Texas fab producing from July 2025 through December 2033; Musk said the deal “could become several times larger.” It’s a coup validating Samsung’s semiconductor technology in EVs. Samsung Foundry is also in talks with NVIDIA on 2-nanometer, pushing mass production against TSMC, and it signed a contract with DeepX, a Korean AI-chip startup—accelerating its AI-chip push. These wins blend technological innovation with global partnerships—riding a semiconductor upcycle and the AI boom. Shares moved up, too: after the verdict, Samsung Electronics rose over 3% back above ₩70,000, reviving “₩70,000-Samsung,” with group stocks rallying on foreign buying as legal risk faded. That signals restored investor trust and brighter growth prospects.

■ Outlook: At the Fork of Light and Shadow

Samsung stands at a crossroads. The acquittal brings legal stability, but the divorce, propofol, and unfair-merger controversies scarred trust. Through “New Samsung,” Lee has promised transparency and social responsibility, but the hangover of past scandals will not vanish quickly. A bigger front-line role for Lee Boo-jin could herald change via female leadership, yet the deep-rooted inertia of chaebol culture remains a challenge.

A CEO’s private and legal lapses are not merely personal—they fuel social inequality and erode economic justice. And yet the Tesla and NVIDIA deals, rising shares, and the triumph of the Galaxy S25 and Z Fold7/Flip7 show Samsung’s potential to re-ascend as a global leader. Lee’s anti-authoritarian style and pledge to end fourth-generation succession could steer Samsung toward a more inclusive, sustainable path. Notably, the Z Fold7/Flip7’s resonance with MZ consumers suggests his future-minded vision has struck a chord—repositioning Samsung beyond the iPhone. If Samsung turns past lessons into institutional transparency and accountability, the “Republic of Samsung” stigma can fade. Readers should face both lights and shadows and weigh conglomerates’ responsibilities alongside their promise. Samsung’s next move will shape the future of Korea’s economy.

관련기사

- [이재훈의 X파일 1화] 이재용 회장 삼성 제국의 빛과 그림자

- [Cover Story] Koo Yoon-Cheol, Deputy Prime Minister and Minister of Economy and Finance

- [뉴스팝콘] 이재훈의 X파일 1화 삼성 제국의 빛과 그림자

- [Lee Jae-hoon's X-File, Episode 2] Koo Kwang-mo’s LG: ‘Tranquil Empire’ or ‘Invisible Turbulence’?

- [Jaehoon Lee’s X-File, Episode 3] Euisun Chung: The Unmasked Ambition of Hyundai’s “Crown Prince”