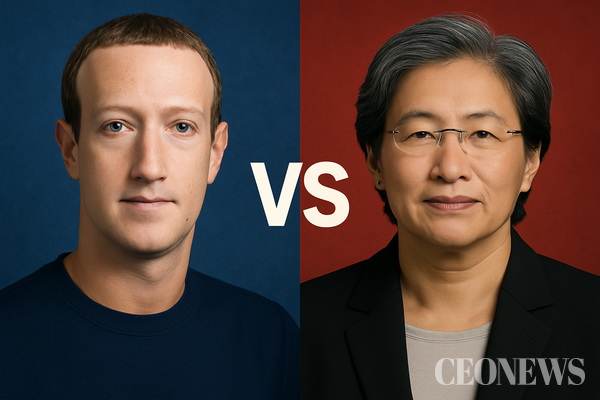

Reading the Intersection and Divergence of Their Strategies

[CEONEWS—Reporter Kim So‑young] Two “tech emperors” leading the social media empire and the semiconductor renaissance have come head-to-head. Meta’s founder and chairman Mark Zuckerberg and AMD’s CEO Lisa Su are the protagonists. Although they contrast sharply in industry focus, culture, and innovation methods, they share a common DNA. Here, we examine their differences and similarities through leadership style, management philosophy, organizational culture, innovation approach, and performance metrics.

■ Vision-Driven vs. Execution Maestro

Zuckerberg is a big‑vision leader who has swung Meta’s full weight behind the “metaverse,” rallying the entire organization around this long‑term project with the motto, “Connecting people, redefining space.” In contrast, Lisa Su is an execution maestro, managing quarter‑by‑quarter metrics down to the minute to earn market trust.

■ Maximizing Connectivity vs. Pushing Performance to the Limit

Zuckerberg’s philosophy—“Connectivity changes society”—prioritizes community expansion over ad revenue. By contrast, Su believes “performance equals competitiveness,” pursuing peak semiconductor performance to gain market share. Meta reshaped its ecosystem through Instagram, WhatsApp, and Oculus, while AMD did so with EPYC server CPUs and Radeon GPUs.

■ Accelerating Experiments vs. Strengthening Collaboration

Meta’s culture is built on speed: “Move fast and break things,” running endless A/B tests with small teams. Yet the bloated organization has shown weaknesses in managing regulatory and ethical risks. AMD, on the other hand, emphasizes cross‑functional collaboration among engineering, manufacturing, and marketing, uniting traditional manufacturing experts with Silicon Valley engineers in a no‑barrier communication structure.

■ In‑House DIY vs. External Alliances

Meta pursues DIY innovation through internal development and M&A—integrating its AI engine and VR/AR solutions into the metaverse platform. AMD, however, builds ecosystems with external partners like TSMC, Microsoft, and Google. It keeps its core design expertise in‑house while outsourcing fabrication to partners to adopt cutting‑edge processes on schedule.

■ Performance by the Numbers

As of 2024, Meta boasts 3 billion monthly active users (MAU), $115 billion in annual ad revenue, and a 120% stock gain over five years. AMD posted $27.2 billion in 2024 revenue, grew server CPU share from 12% to 18%, and data‑center GPU share from 20% to 40%, while stock soared 350% over the same period.

■ Shared DNA: Long‑Term Vision, Data‑Driven Decisions, Talent Obsession

Despite different industries and business models, both leaders share three traits:

A long‑term plan looking five to ten years ahead.

A data‑centric culture of daily and weekly metric monitoring, experimentation, and validation.

An obsession with recruiting top talent to amplify organizational capabilities.

Meta and AMD operate on different stages and with different models. Yet they both exemplify the innovation cycle: “Long‑term vision → data‑driven execution → top talent acquisition.” Korean companies, too, must balance connectivity and performance when pivoting their cash cows toward AI, platforms, and new markets.

“Execution is as vital as vision. Use data and talent to realize your vision.”

That’s the message of CEO DNA Analyst Episode 4.

관련기사

- [CEO DNA 애널리스트 ④] 마크 저커버그 vs 리사 수

- [CEO DNA Analyst 3] Satya Nadella vs Sunda Pichai

- [CEO DNA 애널리스트 ③] 사티아 나델라 vs 순다 피차이

- [CEO DNA Analyst 2] Jeff Bezos vs. Tim Cook

- [CEO DNA 애널리스트 ②] 제프 베이조스 vs 팀 쿡

- [CEO DNA Analyst ] Elon Musk vs. Jensen Huang

- [CEO DNA 애널리스트 ①] 일론 머스크 vs 젠슨 황

- [CEO DNA Analyst ⑤] Sam Altman vs. Reed Hastings

- [뉴스팝콘] 마크 저커버그 VS 리사 수 CEO DNA 분석 4화

- [CEO DNA Analyst #6] Dealmakers of Innovation, Jack Ma vs. Lei Jun